We analyzed 920 automation jobs posted on Upwork to understand what small and medium businesses are actually willing to pay to solve. The findings reveal recurring pain points, emerging trends, and validated opportunities in the automation and micro-SaaS space.

Why Upwork Data Matters for Product Validation

Most market research relies on surveys, interviews, or indirect signals. Upwork job postings are different: they represent real businesses with budgets, actively searching for solutions to specific problems. When someone posts a job asking for help automating quote generation or building a custom dashboard, they're revealing unmet needs in the market.

Our analysis covers:

- 780 jobs from the general automation feed (February 2, 2026)

- 140 jobs from targeted "api automation" searches (February 3, 2026)

- Pattern matching across job descriptions to identify recurring problems

- Tool and platform mentions to understand the existing ecosystem

Methodology: How We Collected and Analyzed the Data

We captured network traffic (HAR files) from Upwork's job feeds using browser DevTools, then parsed the JSON responses to extract job metadata. The analysis involved:

Data Collection

- Feed dataset: 780 jobs from the general "find-jobs" feed (broad automation queries)

- Search dataset: 140 jobs from targeted "api automation" searches (more specific intent)

- Both datasets captured in early February 2026

Pattern Analysis

We used regex pattern matching on job titles and descriptions to identify recurring themes. Each job could match multiple patterns (e.g., a job asking for "CRM to PDF quote generation" would match both "Document/PDF" and "CRM" patterns). Key focus areas:

- Problem patterns: What pain points are mentioned (manual work, reporting, lead follow-up)

- Tool mentions: Which automation platforms appear (Zapier, n8n, Make.com)

- System integrations: Which software needs connecting (CRMs, spreadsheets, accounting tools)

- Industry signals: Vertical-specific language (construction, real estate, agencies)

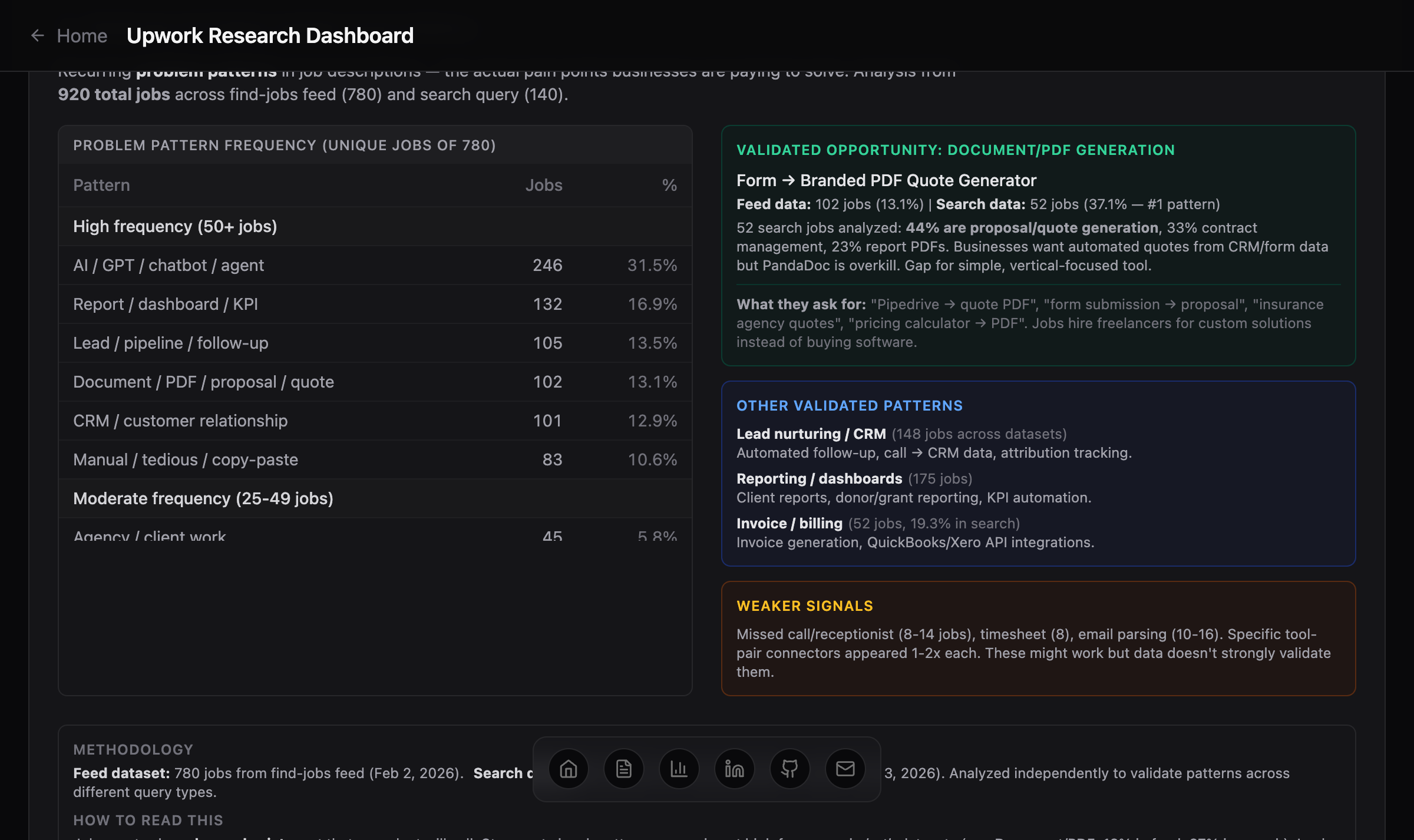

Key Finding: The Most In-Demand Automation Patterns

Six problem patterns dominated the dataset, appearing in over 10% of jobs each. These represent the core automation needs businesses are actively hiring for.

1. AI Integration (246 jobs, 31.5%)

Nearly one-third of automation jobs mention AI, GPT, chatbots, or AI agents. Businesses want to add conversational interfaces, automate responses, or leverage LLMs for data processing. However, "add AI" is a capability, not a specific product: these jobs vary widely in scope.

What they're building: Customer support chatbots, lead qualification bots, document summarization tools, GPT-powered content generation, AI research assistants.

2. Reporting and Dashboards (132 jobs, 16.9%)

Businesses struggle to consolidate data from multiple sources into actionable views. They hire freelancers to build custom dashboards pulling from CRMs, ad platforms, analytics tools, and databases.

Common requests: Client reporting dashboards, KPI automation, donor/grant reporting for nonprofits, marketing ROI dashboards, operational metrics for field services.

3. Lead Management and Follow-Up (105 jobs, 13.5%)

Sales automation dominates this category. Businesses want automated lead nurturing sequences, CRM data entry from calls or forms, and attribution tracking to understand which marketing channels drive conversions.

Pain points: Manual follow-up, leads falling through cracks, no visibility into pipeline health, disconnected tools (website form to spreadsheet to CRM).

4. Document and PDF Generation (102 jobs, 13.1%)

This is where our analysis gets interesting. Document generation appeared at 13.1% in the general feed and 37.1% in the targeted search query, making it the #1 pattern in the API automation dataset. Businesses need automated quote generation, proposal templates, contract creation, and branded PDF reports.

Why this matters: Tools like PandaDoc exist but are expensive and overkill for simple use cases. Businesses hire freelancers to build custom Zapier to PDF workflows because existing solutions don't fit their budget or workflow.

5. CRM Data Management (101 jobs, 12.9%)

Keeping CRM data clean, updated, and connected to other systems is a persistent challenge. Jobs request automated data entry, duplicate detection, contact enrichment, and syncing CRM with external tools.

6. Manual Work and Copy-Paste Pain (83 jobs, 10.6%)

Direct pain language appears in 10%+ of jobs: descriptions explicitly mention "tedious," "manual," "copy-paste," or "repetitive" work. This validates that businesses recognize automation opportunities even if they can't articulate the technical solution.

The Automation Tool Landscape

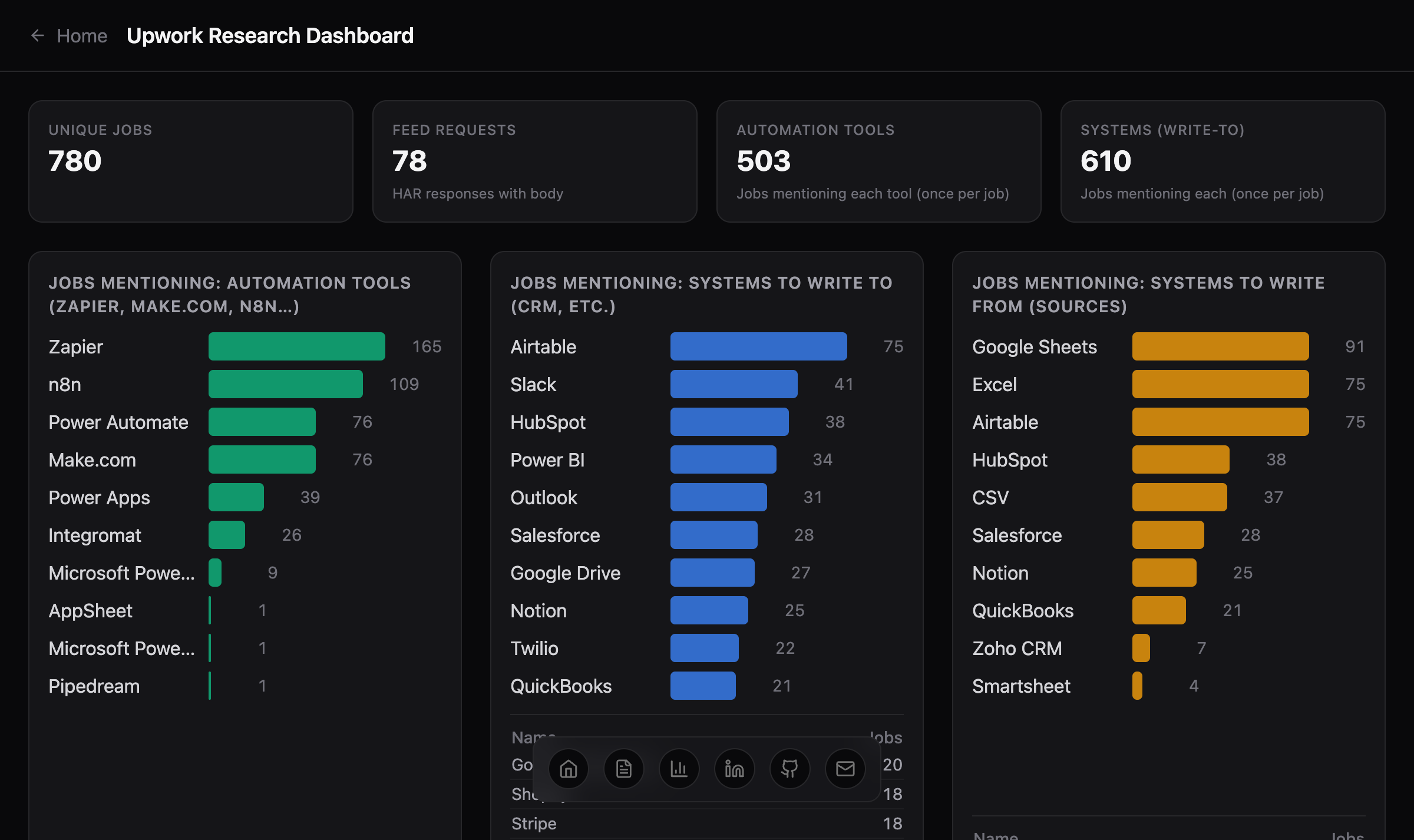

Zapier dominates with 165 mentions (21% of jobs), but open-source and self-hosted alternatives are gaining traction.

Top Automation Platforms

- Zapier: 165 jobs (21.2%), market leader, easiest for non-technical users

- n8n: 109 jobs (14.0%), open-source, developer-friendly, self-hosted

- Power Automate: 76 jobs (9.7%), Microsoft ecosystem, enterprise adoption

- Make.com (formerly Integromat): 76 jobs (9.7%), visual workflow builder

- Power Apps: 39 jobs (5.0%), no-code app development

Insight: The high mention rate for n8n (14%) shows businesses are willing to use open-source tools to avoid per-task pricing. This suggests cost sensitivity and openness to technical solutions.

Most Integrated Systems (Write-To)

These are the destinations where businesses want data to land:

- Airtable: 75 jobs, flexible database for operations, project management

- Slack: 41 jobs, team notifications and alerts

- HubSpot: 38 jobs, CRM and marketing automation

- Power BI: 34 jobs, business intelligence and reporting

- Salesforce: 28 jobs, enterprise CRM

- QuickBooks: 21 jobs, accounting and invoicing

Validated Micro-SaaS Opportunity: Document Generation

The strongest signal from our analysis is Form to Branded PDF Quote/Proposal Generation. This pattern appeared consistently across both datasets:

- Feed data: 102 jobs (13.1%)

- Search data: 52 jobs (37.1%), #1 pattern in API automation queries

What Businesses Are Asking For

After analyzing 52 document-related jobs in detail, we identified three main categories:

- Proposal/Quote Generation (44%): "CRM data to branded quote PDF," "form submission to insurance quote," "pricing calculator to proposal document"

- Contract Management (33%): Template-based contract generation, e-signature workflows, document versioning

- Report PDFs (23%): Automated client reports, performance summaries, invoices with line items

The Gap in the Market

PandaDoc, DocuSign, and Proposify exist but face adoption barriers:

- Cost: $49-99/user/month is expensive for small businesses sending 20-50 quotes monthly

- Complexity: Enterprise features create friction for simple use cases

- Integration friction: Requires manual setup, no pre-built workflows for vertical-specific tools

Businesses hire freelancers to build custom Zapier/n8n workflows instead of buying software. This signals willingness to pay for solutions, but existing products don't fit the need.

Potential Product Angle

A focused micro-SaaS targeting specific verticals could capture this market:

- Insurance agencies: Form data to branded policy quotes with pricing tables

- Construction/contractors: Project estimates with line-item breakdowns, scope of work templates

- B2B services: Proposal automation from CRM data (Pipedrive to PDF, HubSpot to branded proposal)

Other Validated Patterns Worth Exploring

Lead Nurturing and CRM Automation

148 jobs across datasets mention lead follow-up, pipeline management, or CRM updates. Many existing tools serve this space (ActiveCampaign, HubSpot sequences), but vertical-specific solutions could differentiate:

- Real estate agent follow-up sequences (tailored to buyer/seller journeys)

- Call to CRM data entry for field service businesses

- Attribution tracking for agencies managing multiple client campaigns

Reporting and Dashboard Automation

175 jobs request custom dashboards or automated reporting. Common themes:

- Client-facing dashboards for agencies (marketing ROI, ad performance)

- Operational dashboards for construction/field service (job costs, project status)

- Donor/grant reporting for nonprofits

Invoice and Billing Automation

52 jobs (19.3% in the search dataset) mention invoice generation or QuickBooks/Xero integrations. Businesses want automated invoicing triggered by project milestones, recurring billing, or time tracking data.

Vertical Signals: Industry-Specific Opportunities

Certain industries appeared frequently enough to suggest vertical SaaS opportunities:

Construction and Field Services (29 jobs, 3.7%)

Common requests: job costing automation, scheduling coordination, project status dashboards, QuickBooks integration, estimate to invoice workflows.

Real Estate (27 jobs, 3.5%)

Lead management for agents, automated property listing syndication, buyer/seller CRM workflows, open house follow-up sequences.

Agency Operations (45 jobs, 5.8%)

Client reporting automation, campaign management, time tracking to invoicing, white-label dashboards agencies can resell.

Weaker Signals: Patterns That Don't Validate (Yet)

Some commonly discussed micro-SaaS ideas appeared infrequently in our data:

- Missed call/AI receptionist: Only 8 jobs (1.0%), not a strong pattern here

- Timesheet/time tracking: Only 8 jobs (1.0%), existing tools (Harvest, Toggl) likely cover this well

- Email parsing/inbox automation: 10-16 jobs (1.3-4.3%), lower frequency than expected

These might still be viable, but this dataset doesn't strongly support them. Consider validating through other channels before building.

How to Use This Data for Product Decisions

1. Look for Pattern Overlap

The strongest opportunities appear at the intersection of multiple patterns. For example:

- Form (38 jobs) + Document/PDF (102 jobs) = Quote generator

- Lead management (105 jobs) + SMS (37 jobs) = Automated follow-up via text

- Construction (29 jobs) + Dashboard (132 jobs) = Contractor ops dashboard

2. Validate Across Datasets

Patterns that appear in both the general feed and targeted search queries have stronger signals. Document/PDF generation appeared at 13% in feed and 37% in search, this consistency validates demand.

3. Focus on Vertical Niches

Generic automation tools exist. The opportunity is in building for specific industries that have unique workflows:

- "Dashboard for construction project managers"

- "Quote generator for insurance agencies"

- "Client reporting automation for marketing agencies"

4. Consider Build vs. Buy Economics

When businesses hire freelancers instead of buying software, they're signaling that existing solutions are too expensive or complex. Target the "hire a freelancer to build a Zapier workflow" market with productized solutions.

Limitations and Caveats

This analysis has important limitations:

- Single snapshot: Data captured over 2 days in February 2026. Job mix varies by season and trends.

- Selection bias: Seed queries were automation-focused, which skews toward integration work.

- Pattern matching errors: Regex can miss synonyms or catch false positives.

- No conversion data: We don't know which jobs got filled, at what price, or client satisfaction.

- Job counts are not equal to market size: Demand exists, but pricing, competition, and willingness to adopt SaaS are unknowns.

Use this as directional insight, not gospel. Validate through customer interviews, MVPs, and real sales.

Conclusion: What This Means for Builders

Our analysis of 920 Upwork automation jobs reveals clear patterns in what SMBs are willing to pay to solve. The strongest signals point to:

- Document/PDF generation (especially quote/proposal automation)

- Reporting and dashboards tailored to specific industries

- Lead nurturing and CRM automation with vertical focus

The opportunity isn't in building "another Zapier" or generic automation. It's in solving specific workflows for specific industries. Construction companies, real estate agents, insurance agencies, and marketing agencies all need automation, but their workflows differ enough that generic tools fall short.

The fact that businesses hire freelancers to build custom workflows signals a market gap. They're willing to pay, but existing products don't fit. That's where focused micro-SaaS wins.